Have you ever wondered how much value an ADU adds to your property?

Across California, more homeowners are turning their backyards, garages and other existing spaces into accessory dwelling units (ADUs) that generate rental income, boost resale value, and future-proof their homes.

In a state facing a persistent housing shortage, adding an ADU helps increase housing availability while also enhancing property value.

But exactly how much does an ADU increase property value in California, and what kind of return on investment (ROI) can you expect? This guide breaks down the numbers, drawing from industry research and real-world examples to help homeowners make informed decisions about building an ADU.

Whether you’re considering a detached ADU, a garage conversion, granny flat, or an in-law suite, this guide explains how to maximize your property’s financial potential.

How Much Value Does An ADU Actually Add?

Adding accessory dwelling units (ADUs) can significantly increase property value, though the exact figure depends on several key factors such as:

- size

- location

- design quality; and

- local rental demand

ADUs consistently prove to be a good investment, often outperforming traditional home-improvement projects in California’s competitive real estate market.

Average Property Value Increase

According to the National Association of Realtors, building an ADU can increase a home’s property value by about 35% nationwide. In California, where the ADU market is more developed and demand is stronger, industry data shows that value gains of about 30% are common.

For example, a $200,000 ADU construction project could add $60,000 to $80,000 to the appraised value, depending on market conditions and the quality of finishes. In high-demand regions, that increase can be even higher, particularly if the ADU generates steady rental income or expands livable space in a constrained housing market.

Regional Variations in Value Added

Location plays a critical role in determining how much value an ADU adds to a house. Urban and coastal markets, such as Los Angeles, San Francisco Bay Area, and San Diego, tend to see the greatest value gains because of high costs and strong rental demand.

A study by the Federal Housing Finance Agency (FHFA) found that homes with ADUs in California had a median appraised value of $1,064,000, compared to $715,000 for similar homes without ADUs. That’s a difference of about 67%, demonstrating the strong impact of ADUs on overall property values in California.

Other academic research suggests that ADUs may increase property value by 40% to 60% in certain favorable jurisdictions.

The Appraisal Formula

Appraisers typically use two methods when calculating ADU value: the comparable sales approach and the income approach.

- Comparable Sales Approach: Evaluates homes with similar ADUs and adjusts based on square footage, condition, location, and market trends.

- Income Approach: Used primarily for rental ADUs. It estimates net operating income and applies a capitalization rate to determine value contribution.

For example, consider an 800-square-foot detached ADU in Los Angeles renting for $2,500 per month. That’s $30,000 in annual income. After subtracting $6,000 in yearly expenses — including utility costs, maintenance, insurance, and property taxes — the net income is $24,000. Using a 10% capitalization rate, the ADU’s estimated value is $240,000.

It’s also helpful to differentiate between appraised value (commonly used by lenders for loans) and market resale value (what buyers are willing to pay). This helps homeowners understand how an ADU project contributes to property value.

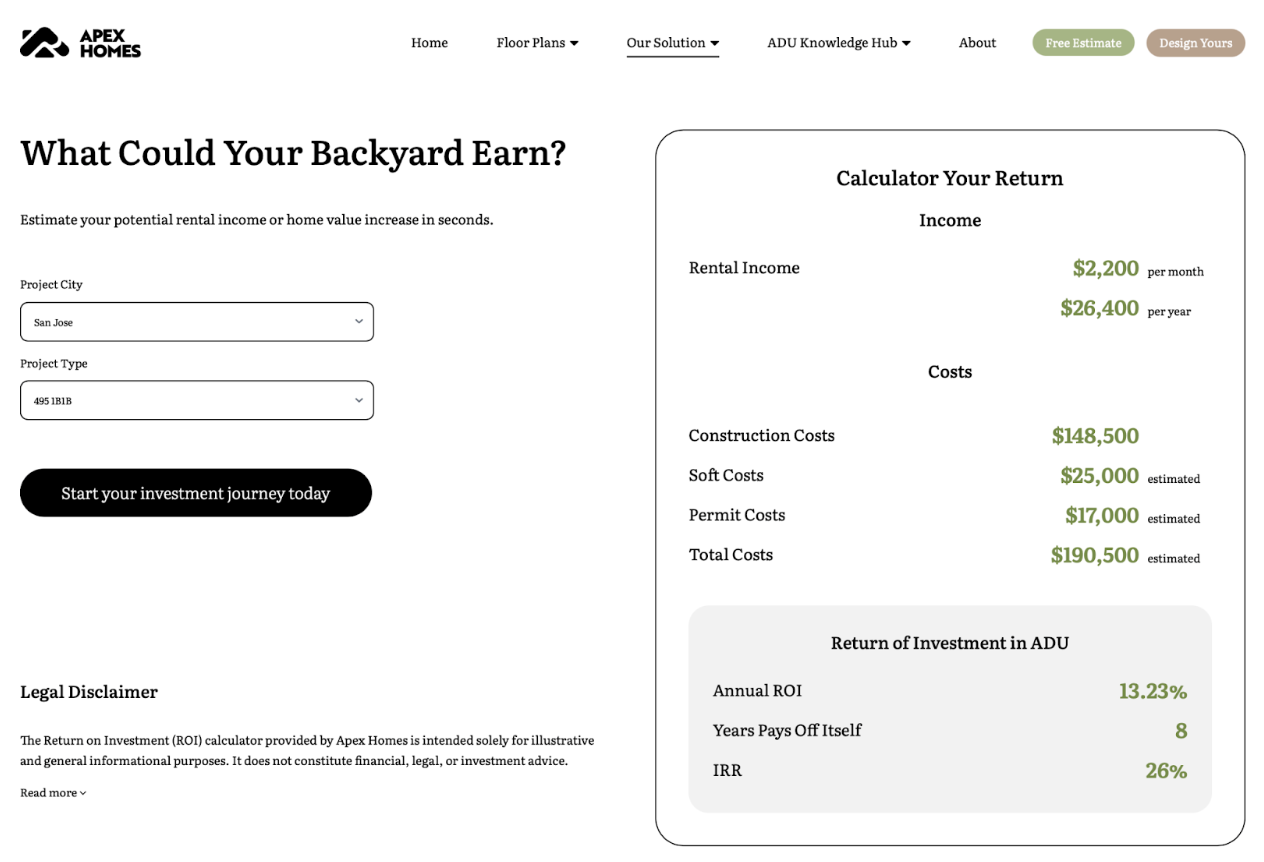

For a more complete financial picture, Apex Homes’ ROI calculator goes beyond appraisal, estimating annual cash flow, payback period, and internal rate of return so homeowners can evaluate the ADU as a long-term investment.

ADU Type and Value: Which Adds The Most?

The type of ADU you build directly ROI and property value. Choosing the right design ensure you get the best balance between cost, livability, and long-term return.

Detached ADUs (Highest Value)

Detached ADUs — standalone structures built in the backyard or side yard — consistently deliver high value increases. They offer privacy, design flexibility, and strong rental property potential. Because they require separate foundation, utilities, and stricter zoning compliance, they also come with higher ADU construction costs, ranging from $250,000 to $400,000.

However, they often yield the strongest returns. A typical detached unit can increase overall property value by $368,000 on average, making it ideal for homeowners seeking both extra income and long-term appreciation.

Attached ADUs

Attached ADUs are extensions of the existing home, sharing one or more walls while maintaining a separate entrance, kitchen, and bathroom. They are a cost-effective way to add livable space without the expense of building a new detached structure.

Industry insights indicate that costs typically range from $180,000 to $300,000, or around $250-$400 per square foot, depending on finishes. These attached units are especially attractive for multigenerational families or homeowners who want rental flexibility without sacrificing proximity or comfort.

Understanding ADU ROI

Evaluating ADU ROI is essential for homeowners considering building an ADU. By analyzing potential rental income and construction costs, you can see how much value the unit could add to your property and overall financial portfolio.

Calculating Your ADU ROI

A simple formula can estimate your ADU ROI:

ROI = (Net Annual Income ÷ Total Investment Cost) x 100

For instance, a Los Angeles homeowner invests $180,000 in an attached ADU that earns $24,000 in annual rent and costs $6,000 annually to maintain. The net income of $18,000 equates to a 10% first-year ROI.

10% = (18,000 ÷ 180,000) x 100

This illustrates how even modestly priced ADUs can provide strong returns, especially in areas with high rental demand.

Rental Income Impact on ROI

Rental income is one of the strongest financial motivators for ADU development. Across California, ADU expected rental rates remain strong:

- Los Angeles: approximately $2,050 per month

- San Diego: approx. $2,250 per month

- Orange County: approx. $2,500 per month

- Riverside County: approx. $1,900 per month

In high-demand areas, such as Los Angeles, an ADU can generate $2,000 to $4,000 per month, add $200,000 to $500,000 to property value, and achieve between 8-12% ROI. That means an ADU can pay for itself in as little as 8 to 10 years while continuing to produce passive income and appreciation gains.

Beyond personal benefits, ADUs also expand affordable housing options — contributing to local communities while strengthening homeowner equity.

Long-Term Appreciation

Over time, ADUs don’t just generate income; they help homes appreciate faster. Data suggests that properties with ADUs appreciate about 9% annually, compared to around 7% for non-ADU homes.

This accelerated growth helps build home equity faster, improves resale potential, and creates a cushion for future financing opportunities like a home equity loan or home equity line of credit.

While ADU construction costs can be significant upfront, long-term gains — combined with potential mortgage interest deductions and consistent income — make one of the most financially sound real-estate investments available to California homeowners today.

Factors That Influence How Much Value Your ADU Adds

Size and Square Footage

Larger ADUs typically add more property value. Small units (300–500 sq ft) offer modest increases, while mid-size ADUs (500–800 sq ft) provide the best balance between cost and return.

For example, a 1,000-square-foot detached ADU in Los Angeles, with an average construction cost of $600 per square foot, could cost around $600,000 to build. Beyond expanding livable space, this investment can increase your property value by a similar amount, providing both long-term equity growth and rental income potential.

Well-designed units with quality finishes also maximize market appeal and financial return.

Quality of Construction and Finishes

High-quality ADU construction directly correlates with higher appraisals. Durable materials, modern layouts, and energy-efficient systems enhance both comfort and resale potential.

Apex Homes sets the standard for quality craftsmanship, using sustainable materials and modern design to ensure every unit delivers long-term durability and visual appeal. This commitment helps homeowners maximize ROI while maintaining strong market value over time.

Local Rental Market Strength

The local rental market heavily influences how much value an ADU adds. In hot markets like Los Angeles or San Diego, well-located ADUs can generate a $2,150 rent on average, while more suburban areas see slightly lower yields. Understanding your local rental rates helps you estimate ADU ROI and property appreciation more accurately.

Zoning Regulations and Compliance

Following local regulations and building codes is essential. Non-permitted ADUs can negatively affect property taxes, resale value, and financing opportunities. Following all permit requirements — such as setbacks, maximum size, and fire safety codes — ensure compliance and protects your investment.

Apex Homes simplifies this process by managing design, permits, and compliance in-house. Our experts ensure that every project meets California’s latest standards, giving homeowners peace of mind and a clear path to building an ADU that adds substantial value.

Built Your ADU With Apex Homes

Adding an ADU in California is a smart financial investment that boosts property value, generates rental income, and builds long-term wealth.

With Apex Homes, homeowners gain a trusted partner who handles every stage of the project — from concept and design to final construction — with clear communication and dependable timelines.

Explore our ADU models and pricing or get a free estimate to see how we can help you construct an ADU that enhances both your home and financial future.